The Finance for Peace Programme

New approaches to finance peace are urgently needed. Today, 1.8 billion people live in 57 conflict-affected countries, including three quarters of the world’s poorest people. No conflict-affected country is on track to achieve the SDGs, or make basic progress in health, education, poverty or gender equity. Conflict is the major barrier to their development.

Peacebuilding is underfunded. Public money and charitable giving will never be able to finance the peace and development needs of the world. Private investment will therefore make a critical contribution to sustainable development and peace. We know the resources exist: the world has financial resources of USD 294 trillion, many times the cost of achieving the SDGs. Yet finance often cannot reach places that have great needs because of the associated risks, even though many parts of conflict-affected countries are relatively peaceful and contain fast-growing populations and markets that offer significant investment opportunities. In addition, peace programmes and peace expertise (which have the capacity to lower real and perceived risks) are underfunded and poorly aligned to support potential investments, while communities that investments will affect are often not consulted or involved in investment decisions, which gives rise to grievances and exacerbates instability and conflict. It is a situation that is bad for communities, governments and investors.

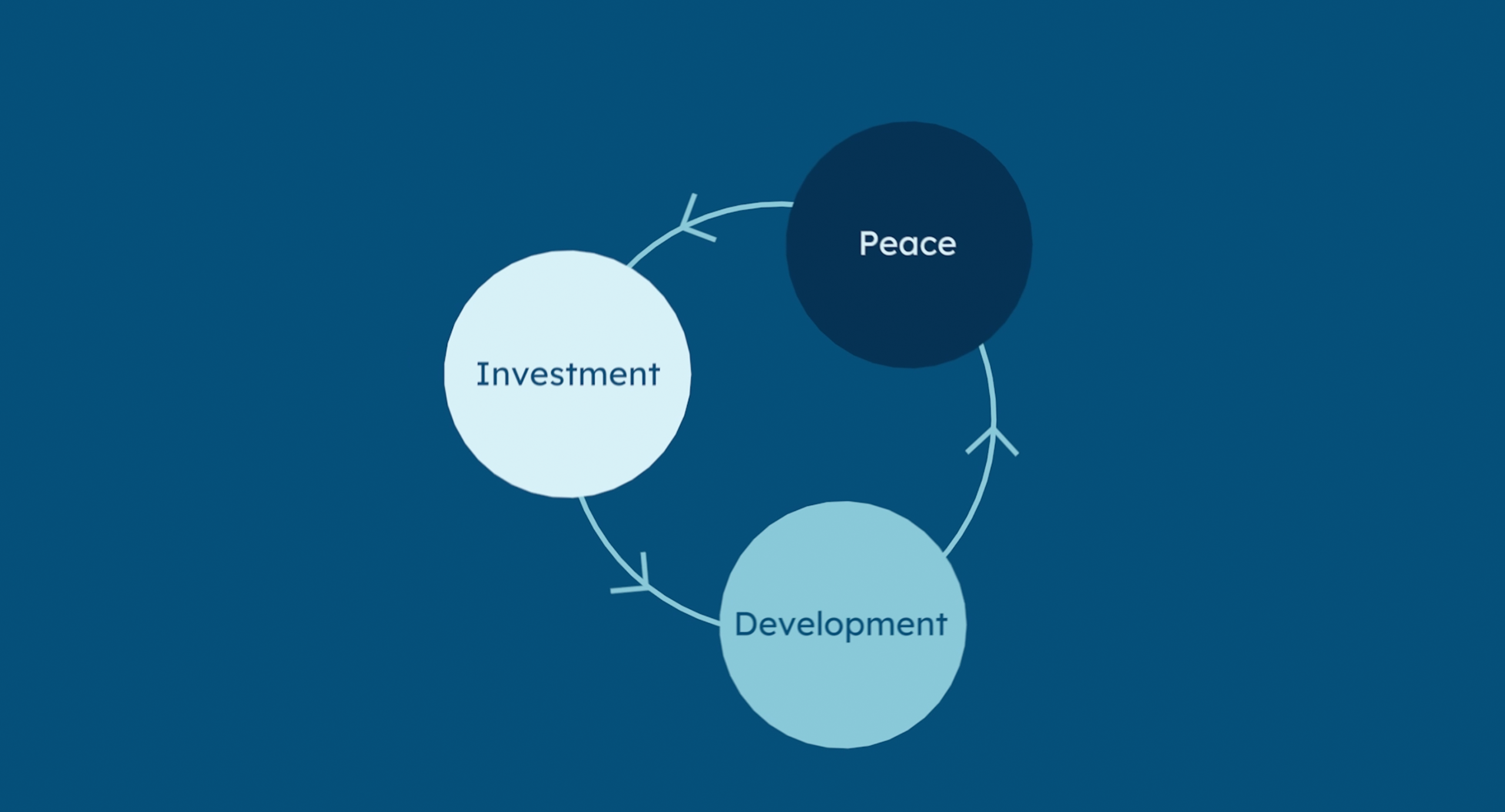

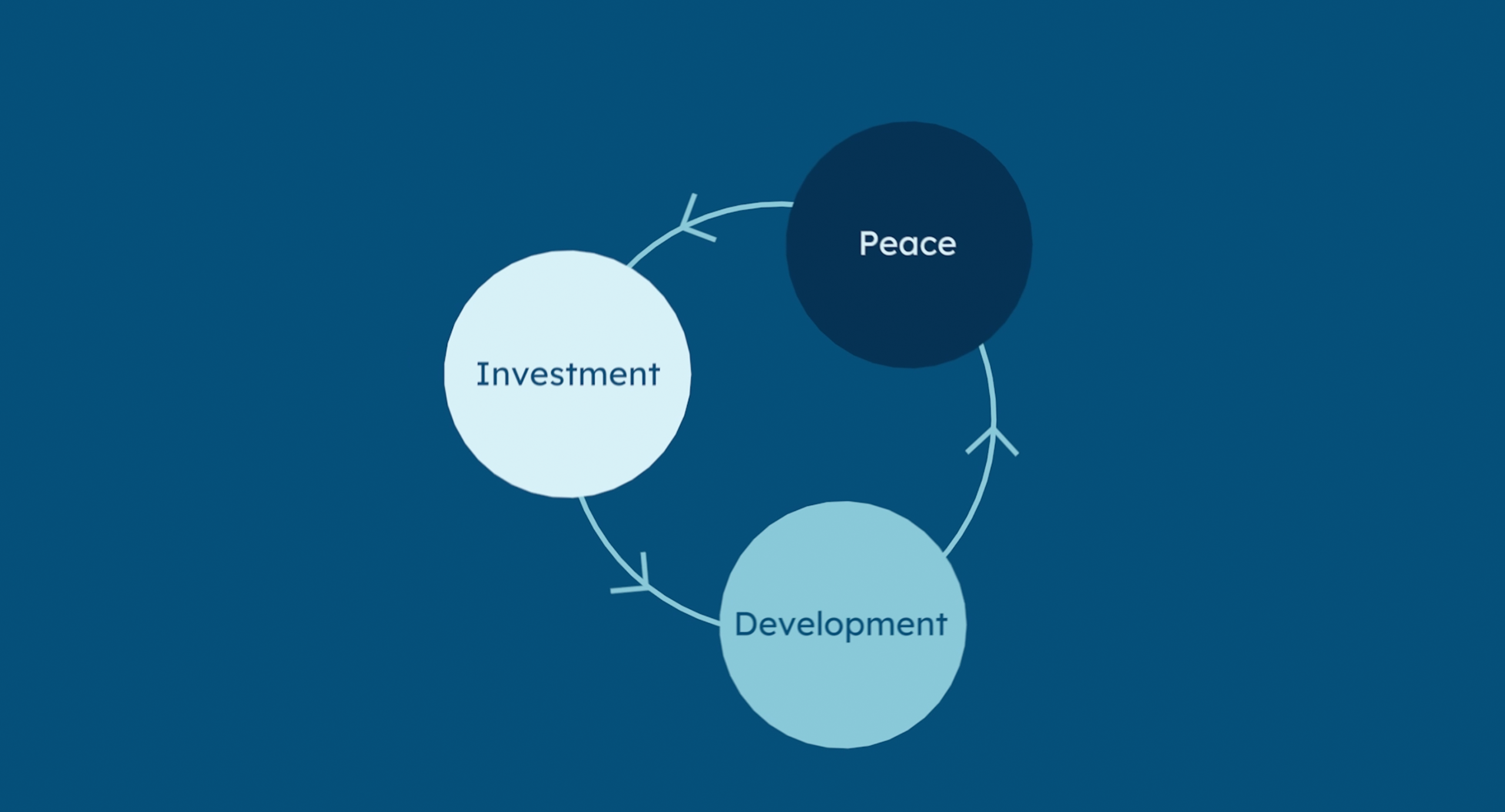

New approaches are needed to fundamentally rethink how peace, development and finance are aligned and how they can work better, together. Aligning peace actions with investment has the potential to be a win-win for people, investors, and governments.

Through the Finance for Peace programme, Interpeace is developing new partnerships, investment approaches and projects to address this challenge. With partners from the private sector, finance, government, and development institutions, it is creating new frameworks, guidance and structures that will increase investment in peace and accommodate market conditions.

In 2022, Interpeace’s Finance for Peace programme consulted hundreds of individual actors from DFIs, donors, UN agencies, and private investors on the conditions that must be in place to make investments in fragile and conflict-affected settings feasible. It also spoke with peacebuilders and researchers on what might facilitate relations with the private sector, and raised awareness of DFI activity in conflict-affected settings. This work encouraged Germany, the main donor, to pursue the programme’s agenda, and other governments are expressing increasing political interest and commitment. DFIs also increased their understanding of peace and conflict issues, and recognised the valuable contribution that peace and peace sensitivity could make to their investments. Several are currently redrafting their fragility and conflict strategies and considering how their investments can be aligned with the peace finance framework. For instance, the UN Capital Development Fund (UNCDF) is considering aligning its blue peace bond with the Peace Finance Impact Framework (PFIF). Finally, private investors who were consulted are becoming more aware of the risk reduction potential of peace actions and are also considering aligning their investments in fragile settings.